iowa inheritance tax rates 2020

See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611. See the Iowa Inheritance Tax Rate Schedule Form 60-061 090611.

3111 Middlewood Rd Midlothian Va 23113 4 Beds 3 Baths Home Dream House Midlothian

See In re Estate of Heuermann Docket No.

. Iowa Department of Revenue 2020. All Major Categories Covered. On May 19th 2021 the Iowa Legislature similarly passed SF.

1 INHERITANCETAX4501 CHAPTER450 INHERITANCETAX Thischapterisinapplicableandtheinheritancetaxshallnotbeimposedonthe. Under the former law which will be in effect until December 31 2024. Iowa inheritance Tax Rate C 2020 Up to 50000.

Iowa has no estate tax but does have an inheritance tax. Iowa Inheritance Tax Rates. States that collect an inheritance tax as of 2020 are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. Iowa of REVENUE Iowa Inheritance Tax Rates httpstaxiowagov Pursuant to Iowa Code chapter 450 the tax rates are as follows. Up to 25 cash back Update.

See Iowa Code section 4504. November 16 2020. Each has its own laws dictating who is exempt from the tax who will have to pay it and how much theyll have to pay.

Track or File Rent Reimbursement. Read more about Inheritance Tax Rates Schedule. Inheritance Tax Rates Schedule.

See IA 706 instructions. If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance. Iowa does have an inheritance tax which beneficiaries are responsible for paying on their inheritance.

Even if no tax is due a return may still be required to be filed. In the meantime there is a phase-out period before the tax completely disappears. Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty percent.

What is the federal inheritance tax rate for 2020. A summary of the different categories is as follows. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original.

What is the federal inheritance tax rate for 2020. That is worse than Iowas top inheritance tax rate of 15. The Iowa inheritance tax rate varies depending on their relationship of the inheritors to the deceased person.

12501-25000 has an Iowa inheritance tax rate of 6. Up to 25 cash back For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out. Skip to main content.

For persons dying on or after January 1 2025 the Iowa inheritance tax is repealed. Value of inheritance. 2021 taxiowagov 60-062 01032022.

Payments under a qualified plan made to the estate of the decedent are exempt from Iowa inheritance tax. For persons dying in the year 2024 the Iowa inheritance tax will be reduced by eighty percent. 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20.

0-12500 has an Iowa inheritance tax rate of 5. It is most common for Iowa inheritance tax to be due when estate shares are left to non-lineal relatives of the decedent such as brothers sisters nieces nephews aunts uncles or cousins. All publicly distributed Iowa tax forms can be found on the Iowa Department of Revenues tax form index site.

75001-100000 has an Iowa inheritance tax rate of 8. Change or Cancel a Permit. IA 8864 Biodiesel Blended Fuel Tax Credit 41-149.

50001-100K has an Iowa inheritance tax rate of 12. For persons dying in the year 2023 the Iowa inheritance tax will be reduced by sixty percent. Register for a Permit.

Read more about Inheritance Deferral of Tax 60-038. 100001-150000 has an Iowa inheritance tax rate of 9. For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out.

A bigger difference between the two states is how the exemptions to the tax work. File a W-2 or 1099. Inheritance Deferral of Tax 60-038.

150001-and more has an Iowa inheritance tax rate of 10. Subject to Iowa inheritance tax. Learn About Property Tax.

Browse them all here. Iowa is planning to completely repeal the inheritance tax by 2025. Over 100000 to 150000.

An exemption from Iowa inheritance tax for a qualified plan does not depend on the relationship of the beneficiary to the decedent. Iowa inheritance Tax Rate C 2020 Up to 50000. It has an inheritance tax with a top tax rate of 18.

In 2021 Iowa decided to repeal its inheritance tax by the year 2025. Iowa inheritance tax is a tax paid to the State of Iowa and is based upon a persons beneficiary or heir right to receive money or property that was owned by another person decedent at the time of death and is passing from the decedent to. Learn About Sales.

How do I avoid inheritance tax in Iowa. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The applicable tax rates will be reduced an additional 20 for each of the following three years.

See General Instructions for Iowa Inheritance Tax Return IA 706. If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero. If you are a parent grandparent great-grandparent child stepchild grandchild great-grandchild or.

Property passing to parents grandparents great. Probate Form for use by Iowa probate attorneys only. Iowa does not have a gift tax.

Iowa County Names and Numbers 76. Over 50000 to 100000. The inheritance tax rate for Tax Rate B beneficiaries ranges from 5 to 10 and the inheritance tax rate for Tax Rate C beneficiaries ranges from 10 to 15.

Select Popular Legal Forms Packages of Any Category. All Major Categories Covered. For deaths occurring on or after January 1 2025 no.

The federal gift tax has a 15000 per year exemption for each gift recipient in 2021 and 16000 in 2022. Read more about IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. Iowa inheritance Tax Rate B 2020 Up to 12500.

The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed. If the net value of the decedents estate is less than 25000 then no tax is applied. What is Iowa inheritance tax.

For more information on the limitations of the inheritance tax clearance see Iowa Administrative Code rule70186122. 25001-75500 has an Iowa inheritance tax rate of 7.

Taxes In Belgium A Complete Guide For Expats Expatica

How To Avoid Inheritance Tax In Iowa

Iowa Estate Tax Everything You Need To Know Smartasset

What Is Inheritance Tax And Who Pays It Credit Karma Tax

Iowa Estate Tax Everything You Need To Know Smartasset

Illinois State Taxes 2022 Tax Season Forbes Advisor

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

State By State Guide To Taxes On Retirees States And Capitals Funny Retirement Gifts Retirement

Quentins Ebook By Maeve Binchy Rakuten Kobo Maeve Binchy Ebook Kobo

Does Apple Aapl Sell A Wireless Router What Happened To The Apple Airport Bloomberg

The Tax Deadline Is May 17 Make These Moves Before You File Forbes Advisor

Iowa Estate Tax Everything You Need To Know Smartasset

Quentins Ebook By Maeve Binchy Rakuten Kobo Maeve Binchy Ebook Kobo

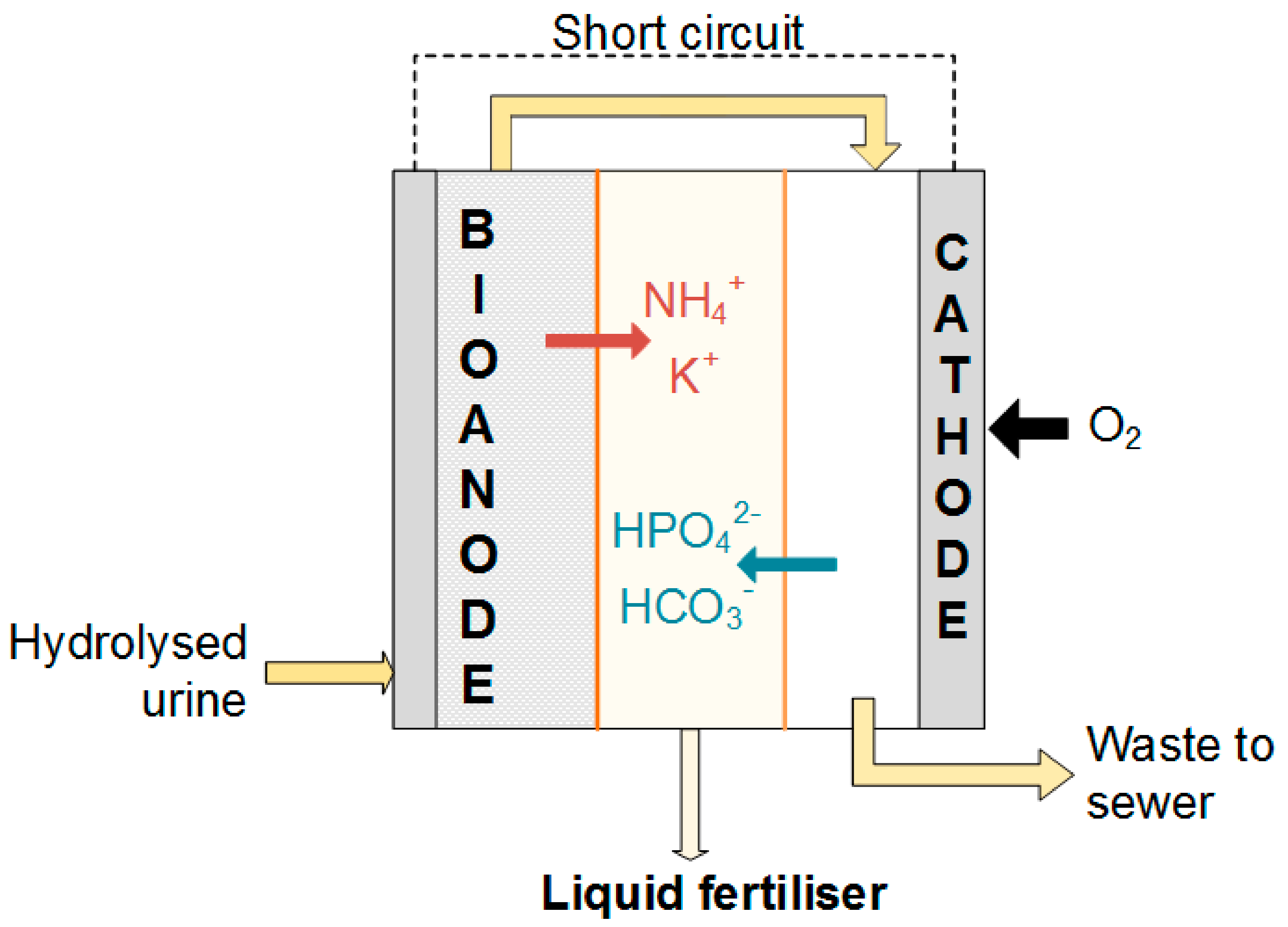

Sustainability Free Full Text Self Powered Bioelectrochemical Nutrient Recovery For Fertilizer Generation From Human Urine Html

Quentins Ebook By Maeve Binchy Rakuten Kobo Maeve Binchy Ebook Kobo

2022 Global Supply Chains Four Trends That Will Shape The Future

Bel Air Home For Sale Luxurious Bedrooms Luxury Homes Dream Houses Dream House Interior